Loading

Get Instructions For Iowa 706 Schedule K Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions For Iowa 706 Schedule K Form online

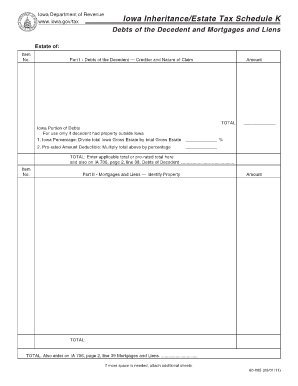

Filling out the Instructions For Iowa 706 Schedule K Form requires careful attention to detail to ensure accurate reporting of debts and mortgages related to the estate. This guide offers comprehensive, step-by-step instructions to assist users in completing the form online with ease and confidence.

Follow the steps to successfully complete the Iowa 706 Schedule K Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I, where you will enter the debts of the decedent. Record the details of each creditor and the nature of their claims in the spaces provided. Ensure accuracy with the total amounts.

- For users with property outside Iowa, calculate the Iowa portion of debts. Divide the total Iowa gross estate by the total gross estate to determine the Iowa percentage, then use this percentage to find the pro-rated amount deductible.

- In Part II, identify any mortgages and liens related to property. Clearly list the properties and corresponding amounts to reflect the estate’s financial obligations.

- Once all relevant fields have been filled out accurately, review your inputs. Ensure that the totals for debts and mortgages are also recorded on the appropriate lines of the IA 706 form.

- After verifying correctness, you may choose to save changes, download, print, or share the completed form as needed.

Start completing your documents online today to simplify your filing process.

Use Schedule E: Jointly Owned Property, when filing federal estate tax returns (Form 706), if the decedent held property of any kind jointly at his or her death. Report property held jointly with the decedent's spouse in Part 1 of Schedule E and list all other jointly held property in Part 2.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.