Loading

Get Items Required To Complete Loan Application - Community First Fund

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Items Required To Complete Loan Application - Community First Fund online

Completing the Items Required To Complete Loan Application for Community First Fund is a crucial step in securing the funding you need. This guide will provide detailed, step-by-step instructions to help you navigate the online form smoothly.

Follow the steps to complete your loan application form online.

- Press the ‘Get Form’ button to access the loan application form and open it for editing.

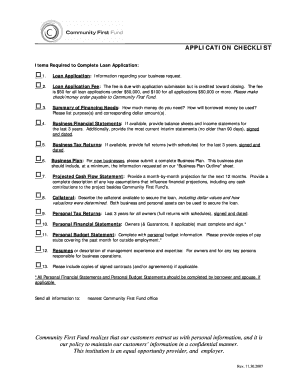

- Begin by filling out the 'Loan Application' section, where you will provide an overview of your business's request for funds, including the amount needed and its intended use.

- Next, indicate the 'Loan Application Fee.' You will need to submit a fee of $50 for loans under $50,000 or $100 for larger loans along with the application.

- In the 'Summary of Financing Needs' section, specify how much money you need and detail the purpose of the funds, including corresponding dollar amounts.

- Provide your 'Business Financial Statements' by including balance sheets and income statements for the last three years, as well as the most recent interim statements (no older than 90 days). Ensure these are signed and dated.

- Attach your 'Business Tax Returns' for the last three years, ensuring they are signed and dated. Include full returns with schedules.

- If your business is new, submit a complete 'Business Plan,' referencing the information requested in the provided 'Business Plan Outline.'

- Create a 'Projected Cash Flow Statement' outlining a month-by-month projection for the next 12 months, detailing key assumptions that influence financial projections.

- Discuss the 'Collateral' you will provide to secure the loan, including valuations of both business and personal assets.

- Include 'Personal Tax Returns' for the last three years for all owners, ensuring they are signed and dated.

- Complete the 'Personal Financial Statements' by having owners and, if applicable, guarantors fill out and sign the required documents.

- Fill out the 'Personal Budget Statement' with detailed personal budget information, including pay stubs from the previous month.

- Provide resumes or descriptions of management experience for owners and key personnel responsible for business operations.

- Attach copies of any signed contracts or agreements if applicable.

- Once all sections are completed, you can save changes, download, print, or share the form as needed.

Start filling out your loan application online today to secure the funding your business needs.

Name – full legal names of all borrowers. Income – you'll supply pay stubs, W2s, and taxes. Social Security Number – so your credit can be pulled.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.