Loading

Get Student Loan Interest Deduction Worksheet

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Student Loan Interest Deduction Worksheet online

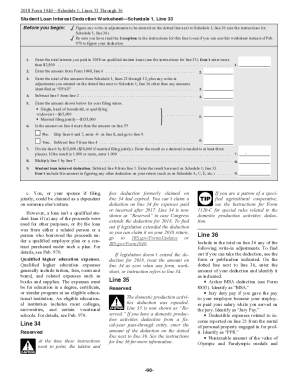

Filling out the Student Loan Interest Deduction Worksheet can help you determine the amount of interest you are eligible to deduct on your federal tax return. This guide provides you with step-by-step instructions on how to complete the form accurately online.

Follow the steps to fill out the Student Loan Interest Deduction Worksheet online.

- Press the ‘Get Form’ button to access the worksheet and open it in your preferred document editor.

- Enter the total interest paid on qualified student loans during the tax year in the first field. Ensure this amount does not exceed $2,500.

- Input the amount from Form 1040, line 22 into the second field.

- Total the amounts from Form 1040, lines 23 through 32, including any write-in adjustments to be entered next to line 36. Enter this total in the third field.

- Subtract the total from line 3 from the amount in line 2. Record this result in line 4.

- Refer to the provided threshold amounts according to your filing status. Enter the appropriate amount in line 5.

- Evaluate whether the amount on line 4 exceeds the amount on line 5.

- If the amount exceeds, subtract line 5 from line 4 and write this result in line 6. Otherwise, skip to line 9.

- Divide the amount in line 6 by the respective threshold ($15,000 or $30,000 if married filing jointly). Round the result to at least three decimal places and enter this on line 7.

- Multiply the amount on line 1 by the decimal result on line 7. Record this in line 8.

- Finally, subtract the amount in line 8 from the total interest in line 1. Enter the result in line 9, and also on Form 1040, line 33.

Complete your documents online for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Claiming the student loan interest deduction To claim the student loan deduction, enter the allowable amount on line 20 of the Schedule 1 for your 2019 Form 1040. The student loan interest deduction is an above the line income adjustment on your tax return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.