Loading

Get Md Contractor Exempt Purchase Certificate Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Md Contractor Exempt Purchase Certificate Form online

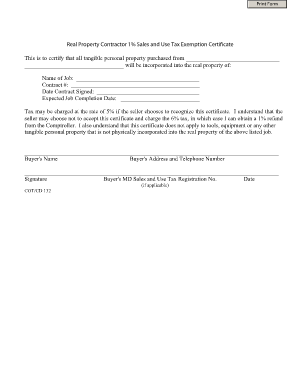

Completing the Md Contractor Exempt Purchase Certificate Form online can streamline your purchasing process and ensure you take advantage of available tax exemptions. This guide will walk you through each section of the form step-by-step, making it easier for you to fill it out correctly.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to access and open the Md Contractor Exempt Purchase Certificate Form in your preferred online editor.

- In the first section, enter the name of the seller from whom you are purchasing tangible personal property. This is crucial to establish the tax exemption.

- Next, provide the name of the job for which the materials are being purchased, ensuring clarity about the project associated with the purchase.

- Fill in the contract number related to the job. This helps to identify the specific agreement for reference.

- Record the date on which the contract was signed, as this signifies the official start of the agreement.

- Indicate the expected job completion date to provide a timeline for the project associated with the purchases.

- Review the information provided to understand the tax implications, including that the seller may choose to charge the standard tax rate.

- Complete the buyer's section, entering your name, address, and telephone number to provide necessary contact information.

- Sign the form to authenticate the details provided. Your signature indicates your agreement to the terms of the certificate.

- Finally, include your Maryland Sales and Use Tax Registration number, if applicable, before saving your completed form.

- Once you have filled in all the necessary sections, you can choose to save changes, download the completed form, print it for your records, or share it as needed.

Start filling out your Md Contractor Exempt Purchase Certificate Form online today to ensure a smooth purchasing process.

Related links form

Maryland personal exemption If your federal adjusted gross income is $100,000 or less, you'll likely qualify for a $3,200 personal exemption (unless you're filing as a dependent eligible to be claimed on someone else's tax return).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.