Loading

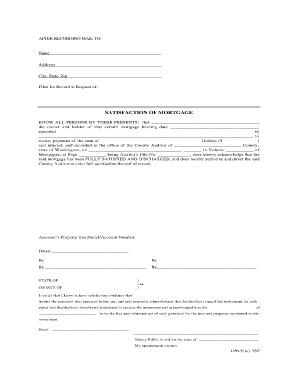

Get South Carolina Lost Mortgage Satisfaction Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the South Carolina Lost Mortgage Satisfaction Form online

Filling out the South Carolina Lost Mortgage Satisfaction Form online can be a straightforward process when you know the steps to follow. This guide will help you understand each part of the form and provide you with clear instructions to ensure accurate completion.

Follow the steps to successfully complete the form online.

- Click 'Get Form' button to access the Lost Mortgage Satisfaction Form and open it for editing.

- In the first section, input the name of the person or entity that holds the mortgage. This identifies the mortgage holder and is crucial for the documentation.

- Next, enter the date on which the mortgage was executed. This helps establish the timeline for the mortgage satisfaction.

- Provide the name of the mortgagor (the individual or entity that borrowed the funds) to clarify who the mortgage pertains to.

- Complete the section that states the total amount of the mortgage, including the principal and any interest as necessary.

- Indicate the county name and date the mortgage was recorded. This information ensures the records are accurate and complete.

- Fill out the Assessor’s Property Tax Parcel/Account Number to associate the satisfaction with the correct property.

- Sign and date the document in the designated areas. Multiple signatures may be required if there are co-owners or other parties involved.

- Once all fields are completed, check the information for accuracy. Then, save the changes or download the form as needed for submission.

- Lastly, you can print the completed form for your records or share it with the necessary parties.

Start filling out your Lost Mortgage Satisfaction Form online now to expedite the completion of your mortgage satisfaction process.

(4) "Satisfaction" means a discharge signed by the mortgagee of record, the trustee of a deed of trust, or by an agent or officer, legal representative, or attorney-in-fact under a written instrument duly recorded, of either of the foregoing indicating that the property subject to the security instrument is released.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.