Loading

Get Promissory Note Release

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Promissory Note Release online

Filling out a Promissory Note Release is an important step in documenting any loan agreements. This guide will provide you with clear instructions on how to complete the form online with ease, regardless of your prior experience.

Follow the steps to complete the Promissory Note Release

- Click the ‘Get Form’ button to access the Promissory Note Release form in your preferred online editor.

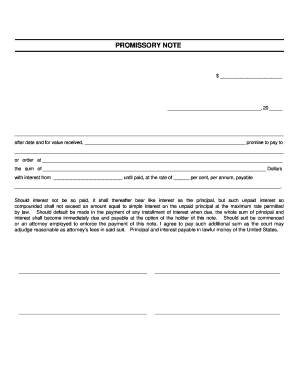

- Enter the amount you are borrowing in the space provided, labeled with a dollar sign.

- Fill in the date on which the agreement will take effect, ensuring to write the full month and year.

- In the designated area, state who the note is being made to and include their full name.

- Specify where the sum will be payable by entering the relevant address in the provided space.

- Indicate the total dollar amount owed by typing the numerical value in the appropriate section.

- After that, include the date from which interest begins to accrue until the amount is fully paid.

- Fill in the interest rate as a percentage, ensuring to follow the required format.

- Detail how interest payments will be made by specifying any relevant terms in the appropriate space.

- Review all the information to ensure accuracy, then save your changes, and look for options to download, print, or share the completed form.

Start completing your Promissory Note Release online today to streamline your document management process.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note. ... Accept full payment of the loan. ... Mark “paid in full” on the promissory note. ... Place a signature beside the “paid in full” notation. ... Mail the original promissory note to the borrower.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.