Loading

Get 2006 Fillable Form K1

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2006 Fillable Form K1 online

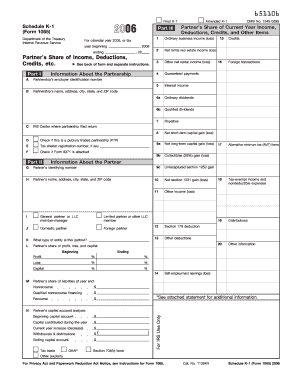

The 2006 Fillable Form K1 is an essential document used to report the income, deductions, and credits for partners in a partnership. This guide provides clear, detailed steps to assist users in efficiently completing this form online, ensuring they successfully capture all necessary information.

Follow the steps to fill out the 2006 Fillable Form K1.

- Click the ‘Get Form’ button to obtain the form and open it in your online editor.

- Begin by entering the partnership’s employer identification number in field A. This is crucial for identifying the partnership involved.

- Fill in the partnership’s name and address in field B. Ensure accurate information to avoid processing delays.

- Indicate if this is a publicly traded partnership by checking the appropriate box in field C.

- In field E, provide the tax shelter registration number if applicable.

- If Form 8271 is attached, check the corresponding box in field F.

- Proceed to Part II. Start entering the income types such as ordinary business income in field 1 and sensitive deductions in fields 12 and 13.

- Correctly allocate shares in fields L for profit, loss, and capital allocations, detailing the beginning amounts where necessary.

- Complete the Partner’s Share of Current Year Income in the sections provided, ensuring all distributions and other essential information are entered.

- After completing all fields, review the form for any inaccuracies. When satisfied, save your changes.

- You can then download, print, or share the completed form as per your requirement.

Start filling out your 2006 Fillable Form K1 online today for a smooth filing experience.

Schedule K-1 line 20N is the partner's share of the amount allowed on page 1 of the 1065 as a deduction. The disallowed portion appears on Schedule K-1 line 13k.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.