Loading

Get Op 424

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Op 424 online

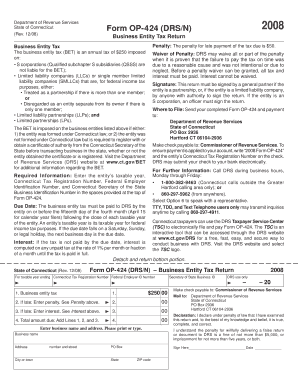

The Op 424 form is a business entity tax return used in Connecticut. This guide will provide you with clear, step-by-step instructions to effectively fill out the Op 424 online, ensuring compliance with state requirements.

Follow the steps to complete the Op 424 online.

- Click ‘Get Form’ button to access the Op 424 form and open it in the designated editor.

- Enter the entity’s taxable year in the appropriate field at the top of the form.

- Complete the sections for Connecticut Tax Registration Number, Federal Employer Identification Number, and Connecticut Secretary of the State Business Identification Number, ensuring accuracy in each.

- For Line 1, indicate the business entity tax by entering the amount of $250.

- If the payment is late, refer to the Penalty section and input the corresponding penalty amount in Line 2.

- Calculate any interest owed using the rate specified and input that amount in Line 3 if applicable.

- Sum Lines 1, 2, and 3 to determine the total amount due, and enter this value in Line 4.

- Provide the business name and address, ensuring all information is typed clearly.

- Finally, sign and date the declaration at the bottom of the form to confirm the accuracy of your information.

- After completing the form, you can save changes, download, print, or share the form as needed.

Complete your Op 424 form online today to ensure timely compliance with Connecticut State requirements.

When filing as a C-Corp, your LLC will need to pay the 21% federal corporate income tax rate along with the 7.5% Connecticut corporate tax rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.