Loading

Get 2009 Calendar-year Filers, Mark An X In The Box: Other Filers Must Enter Tax Period: Beginning

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2009 Calendar-year Filers, Mark An X In The Box: Other Filers Must Enter Tax Period: Beginning online

Filling out the 2009 Calendar-year Filers form can be a straightforward process if you follow the instructions carefully. This guide will provide you with clear steps to successfully complete and submit your claim for the EZ Investment Tax Credit and EZ Employment Incentive Credit online.

Follow the steps to accurately complete the form

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your taxpayer identification number as required. This number is essential for linking your claim to your tax profile.

- Fill in your name(s) as they appear on your tax return. Ensure that the names are entered accurately to avoid any processing issues.

- Indicate the name of your empire zone (EZ). This will connect your claim to the correct geographic area for the tax credits being claimed.

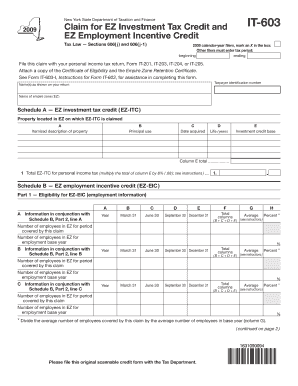

- Proceed to Schedule A for the EZ investment tax credit (EZ-ITC). You will need to provide detailed information about each property for which you're claiming the credit, including an itemized description, principal use, date acquired, life in years, and total investment credit base.

- Next, move to Schedule B for the EZ employment incentive credit (EZ-EIC). Here, you will provide employment information such as the number of employees in the EZ for the period covered by the claim and the employment base year.

- Continue with the calculations in Part 2 of Schedule B, where you will determine the EZ-EIC amount based on previously provided credits.

- Fill out the partnership, S corporation, or estate and trust information in Schedule C if applicable. Ensure you provide the name, type, and employer ID number as needed.

- Complete Schedule D with your share of the credit from partnerships or S corporations, ensuring accurate entries to reflect your entitlement for the credits.

- Finally, review all sections for completeness and accuracy. Once finished, you can save your changes, download a copy of the form, print it for your records, or share it as needed.

Complete your documents online to ensure timely submission and processing.

Typically, the IRS mandates the use of the calendar year for businesses that don't keep books or records. While the Internal Revenue Service alleges that any 12 consecutive months ending in any last day of the month apart from December constitutes a fiscal year, taxpayers see it differently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.