Loading

Get Blank Credit Report

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Blank Credit Report online

Filling out a Blank Credit Report online can empower you to take control of your financial records. This guide will provide step-by-step instructions to help you complete the form accurately and effectively.

Follow the steps to fill out your Blank Credit Report with ease.

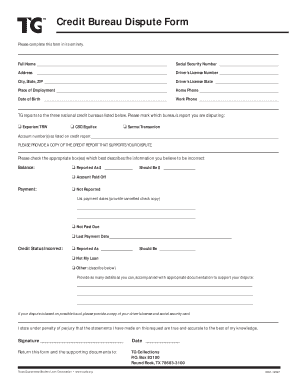

- Press the ‘Get Form’ button to access the Blank Credit Report and open it in the online editor.

- Begin by entering your full name as well as your Social Security number in the respective fields.

- Provide your current address, including your city, state, and ZIP code. Don't forget to include your driver's license number and the state that issued it.

- Indicate your place of employment and provide both your home and work phone numbers for contact purposes.

- Fill in your date of birth to verify your identity.

- Select the credit bureau you are disputing from the options provided: Experian/TRW, CSC/Equifax, or Sarma/Transunion.

- List the account number(s) as they appear on your credit report.

- Select the appropriate boxes that detail the inaccuracies in your credit report regarding balances, payments, and credit status. Provide any necessary supporting details and documentation.

- If applicable, provide a description of any additional disputes or specify if your dispute is based on potential fraud, including necessary documentation.

- Affirm the accuracy of the information provided by signing and dating the form.

- Return the completed form along with any supporting documents to TG Collections at the provided address, and ensure you keep copies for your records.

Start your journey to dispute inaccuracies on your credit report by completing the Blank Credit Report online today.

Related links form

If you haven't used credit in more than 10 years, your old accounts have most likely dropped off your credit report by now, which means there's nothing in your credit history to score. ... Most credit scoring models need at least one or two active credit accounts to generate a credit score.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.