Loading

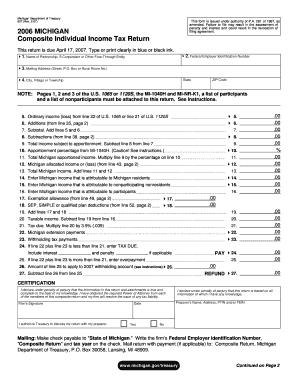

Get 2-07) 2006 Michigan Composite Individual Income Tax Return This Return Is Due April 17, 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2-07) 2006 Michigan Composite Individual Income Tax Return online

This guide provides clear instructions on how to effectively fill out the 2-07) 2006 Michigan Composite Individual Income Tax Return online. It is designed to assist users, including those with minimal legal experience, in accurately completing the required documentation by the deadline.

Follow the steps to complete your tax return with ease.

- Click ‘Get Form’ button to obtain the form and open it in your editing tool.

- Enter the name of your partnership, S corporation or other flow-through entity in the designated field. Ensure that this is clear and correct, as this information is crucial for processing your return.

- Fill in your Federal Employer Identification Number in the specified section. This number is essential for the identification of your business entity.

- Provide your mailing address including street, P.O. Box or rural route number, and ensure accuracy to avoid any delays in communication or processing.

- Complete the city, village, or township field by inputting the appropriate location name, followed by your state and ZIP code.

- Attach the necessary documentation, including pages 1, 2, and 3 of the U.S. 1065 or 1120S, MI-1040H, and MI-NR-K1 for each participant. Ensure all documents are complete and accurate.

- Calculate your ordinary income or loss, and enter this value in the appropriate section on the form. Confirm that this corresponds with the relevant line from your U.S. 1065 or 1120S.

- Proceed to fill out the additions and subtractions as mandated by the state instructions. Be thorough when entering amounts from different categories as detailed in the instructions.

- Determine your total income subject to apportionment by subtracting the subtractions from your subtotal. Enter this calculation accurately.

- Calculate the Michigan apportioned income by multiplying the income subject to apportionment by the apportionment percentage derived from MI-1040H. Enter this value accordingly.

- When you reach the final sections, check your calculations for taxable income, tax due, and whether you are eligible for any refunds or credits. Make sure to complete these sections exhaustively.

- Finally, save your changes, and choose to download, print, or share the completed form as necessary to meet submission requirements.

Complete your forms online today to ensure timely submission and compliance.

A Michigan Composite Individual Income Tax Return (Form 807) is a collective individual income tax filing for two or more participating nonresident members filed by the flow-through entity (FTE). This form is used to report and pay individual income tax under Part 1 of Public Act 281 of 1967, as amended.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.