Loading

Get Property Deed Transfer Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Property Deed Transfer Form online

Filling out the Property Deed Transfer Form online can seem complex, but with clear guidance, you can complete it efficiently. This guide will walk you through each section of the form, providing step-by-step instructions to ensure accuracy and compliance.

Follow the steps to complete your Property Deed Transfer Form online:

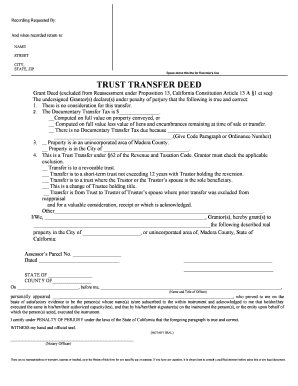

- Click ‘Get Form’ button to access the Property Deed Transfer Form and open it in the appropriate editor.

- Begin by entering the name of the person or entity who requested the recording in the 'Recording Requested By' section.

- In the 'And when recorded return to' section, fill in the name, street address, city, state, and zip code where the form should be returned after recording.

- Indicate whether there is consideration for the transfer by checking the appropriate box under the declaration section.

- Complete the Documentary Transfer Tax section by specifying the applicable amount and checking the correct box based on the tax computation method.

- Indicate the location of the property by checking the correct box for either unincorporated area or city.

- Specify the nature of the trust transfer by checking the relevant box according to the type of trust and its beneficiaries.

- Fill in the names of the Grantor(s) and the recipient in the section that follows, along with a description of the property, including the Assessor’s Parcel Number.

- Provide the date of signing the document in the designated space.

- At the end of the form, ensure to provide necessary signatures and titles, including notary requirements if applicable.

- Finally, save your changes to the form, download a copy for your records, and if needed, print or share it for submission.

Begin the process of filing your Property Deed Transfer Form online today!

Your signed and notarized Warranty Deed needs to be filed in the property records in the county clerk's office of the county in which the property is located. The county clerk will charge a recording fee of about $30 to $40, depending on the county. The fee should be paid by a cashier's check or money order.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.