Loading

Get Publication 4681 Worksheet 2010 Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Publication 4681 Worksheet 2010 Form online

Filling out the Publication 4681 Worksheet 2010 Form online can be straightforward with the right guidance. This comprehensive guide will provide you with clear, step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to successfully complete the form online

- Click the ‘Get Form’ button to access the Publication 4681 Worksheet 2010 Form and open it in your online editor.

- Begin with the personal information section. Enter your full name, address, and contact information as requested in the designated fields. Be sure to double-check for accuracy.

- Move to the financial information section. Provide the required income details, including any relevant tax information. Ensure that all figures are accurate and up to date.

- Proceed to the deduction section. If applicable, list any qualified deductions you are entitled to claim. This can include various expenses, so refer to the guidelines provided in the form for specifics.

- Complete the section regarding additional information. If there are specific circumstances or explanations required, fill them in thoroughly to avoid any misunderstandings.

- Review all entered information carefully. Ensure that all fields are filled out correctly and that there are no errors or omissions.

- Once you are satisfied with your completed form, save your changes. You may choose to download a copy, print it out for your records, or share it as necessary.

Start filing your documents online today for a straightforward experience!

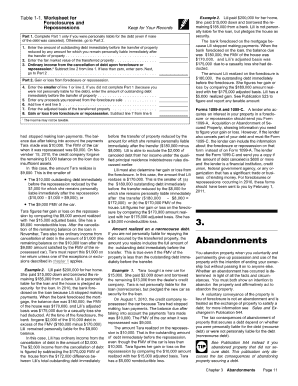

Discharged debt is excluded from gross income if the discharge occurs when the taxpayer is insolvent. For purposes of the exclusion, insolvency is defined as the amount in which the taxpayer's liabilities exceed the taxpayer's assets. The amount excluded by an insolvent taxpayer is limited to the amount of insolvency.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.