Loading

Get Sa 102 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sa 102 Form online

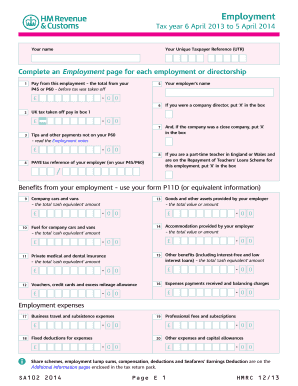

Filling out the Sa 102 Form online is an essential step for individuals reporting their employment income for tax purposes. This guide provides detailed instructions to help you navigate each section of the form seamlessly.

Follow the steps to complete the Sa 102 Form online.

- Click ‘Get Form’ button to access the Sa 102 Form and open it in the designated editor.

- Enter your name as it appears on your tax records in the relevant field.

- Provide your Unique Taxpayer Reference (UTR) in the field designated for this information.

- Complete an Employment page for each job you have held. Begin with the details of your first employment.

- In the corresponding field, report your pay from this employment by entering the amount from your P45 or P60 before tax was deducted.

- If you were a company director, mark 'X' in the provided box to indicate your employment status.

- If applicable, also indicate whether the company was a close company by marking 'X' in the designated box.

- For part-time teachers in England or Wales, if you are part of the Repayment of Teachers' Loans Scheme, check the box provided.

- Report any tips or payments that are not on your P60 by entering the amount in the relevant section.

- Provide your employer's name and the UK tax taken off pay in the respective fields.

- Fill in the PAYE tax reference of your employer, which can be found on your P45/P60.

- Report any benefits received from your employment using your form P11D, including details for company cars, other benefits, and various insurances.

- Document any employment expenses, including travel, professional subscriptions, and fixed deductions.

- Once all sections are completed, review your form for accuracy.

- Save your changes, and download, print, or share the form as necessary.

Start completing your Sa 102 Form online today to ensure your employment income is accurately reported.

Tax Returns / SA100. Log into the HMRC online account (go to https://.gov.uk/sa302-tax-calculation) Scroll down and Log In. Select 'Self Assessment' (if you are only registered for Self Assessment then you will automatically be directed to this screen)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.