Loading

Get Schedule E Income Worksheet Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule E Income Worksheet Form online

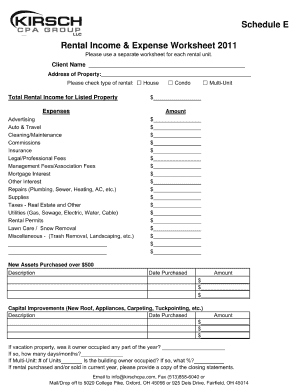

Filling out the Schedule E Income Worksheet Form is essential for accurately reporting rental income and expenses. This guide will walk you through each section of the form, ensuring you can complete it efficiently and correctly, even if you have limited experience.

Follow the steps to complete the Schedule E Income Worksheet Form online

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Review the top section where you will enter your identifying information, including your name and contact details. Accurate information here is crucial.

- Next, navigate to the income section. Here, you will detail each rental property's income, specifying amounts received throughout the year. Make sure to include all relevant income sources.

- Proceed to the expenses section. List all deductible expenses related to your rental properties, such as repairs, maintenance, and property management fees. Be as detailed as possible.

- After filling out all necessary fields, verify that all entries are accurate and consistent with your financial records. Double-check for any arithmetic errors.

- Finally, save your changes. You can download a copy of the completed form, print it for your records, or share it with anyone who may need to review it.

Complete your Schedule E Income Worksheet Form online today.

Schedule E is part of IRS Form 1040. ... Schedule E is for supplemental income and loss, and not earned income. Earned income is income generated from business activities. Supplemental income is considered passive income, such as collecting rent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.