Loading

Get Form 4571

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4571 online

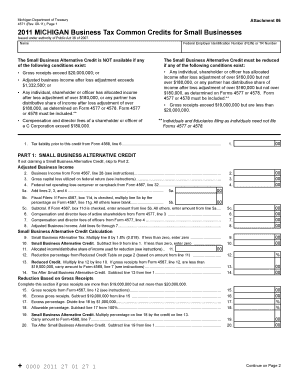

The Form 4571 is essential for calculating the Small Business Alternative Credit and the Gross Receipts Filing Threshold Credit. This guide will provide you with a comprehensive, step-by-step approach to filling out the form online, ensuring a smooth filing process.

Follow the steps to complete your Form 4571 efficiently.

- Press the ‘Get Form’ button to access the Form 4571 and open it in your designated online editor.

- In the first section, provide your business name and Federal Employer Identification Number (FEIN) or TR Number. Ensure accuracy as this information is crucial for identification.

- Review the eligibility criteria for the Small Business Alternative Credit. Be aware that if your gross receipts exceed $20,000,000 or specific income thresholds are met, you may not qualify for this credit.

- In Part 1, fill out the Adjusted Business Income by entering the appropriate figures from Form 4567 as instructed.

- Calculate your Small Business Alternative Credit by following the calculations outlined, ensuring your inputs are from accurate and relevant sources.

- Complete Part 2 only if your apportioned gross receipts are between $350,000 and $700,000, entering the required figures in the designated lines.

- Double-check all entries for accuracy and completeness to avoid potential delays in processing or eligibility issues.

- Once all sections are completed, you have the option to save your changes, download, print, or share the completed Form 4571.

Start completing your Form 4571 online today for a smooth submission process.

Related links form

Any U.S. person (individual, entity (corporation, partnership, trust, or estate)) who owns more than 10% (vote or value) of a foreign corporation will likely be required to file Form 5471. The form is filed as part of the U.S. person's tax return (Form 1040, 1065, 1120, etc.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.