Loading

Get Form 990 -ez 2010 - Donate Perlfoundation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 990 -EZ 2010 - Donate Perlfoundation online

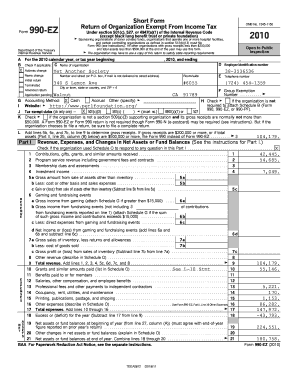

Filing the Form 990-EZ is an essential task for organizations seeking to maintain their tax-exempt status while providing transparency in their operations. This guide offers clear and practical steps to assist users in completing the Form 990-EZ for the year 2010, specifically in relation to the Perlfoundation.

Follow the steps to successfully complete your Form 990-EZ online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In section A, enter the organization’s name, address, and employer identification number (EIN). Make sure to double-check these details for accuracy.

- In section B, indicate the type of return you are filing by checking the appropriate box, such as 'Initial return' or 'Amended return'.

- For section C, indicate the tax-exempt status of the organization by checking the relevant box for 501(c)(3), 501(c)(4), or others as applicable.

- In Part I, provide a summary of the organization’s revenue, expenses, and changes in net assets. Fill out the lines corresponding to contributions, program service revenue, and total revenue carefully.

- Continue to fields that detail specific revenues and expenses, ensuring to complete each line with accurate figures from the organization’s financial records.

- In Part II, detail the balance sheet information including total assets and liabilities. This section should align with your organization's financial statements.

- Proceed to Part III, where you describe the organization's program service accomplishments. Provide detailed descriptions of the services offered and the impact achieved.

- List the officers, directors, and key employees in Part IV, providing their names, titles, and compensation details.

- Complete Part V by answering any additional questions specific to the organization’s activities, such as engagement in lobbying or political campaign activities.

- After thoroughly reviewing the form for accuracy and completeness, save your changes within the editor. You can then download, print, or share the completed form as required.

Start filling out your Form 990-EZ online today to ensure your organization remains compliant and transparent.

Invoice Naming Conventions. The name of your invoice (that is, the subject name and/or the file name) should be a summary of the invoice details that make finding the invoice as simple as possible. Keep in mind that the invoice name may be different than the subject of the invoice.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.