Loading

Get Uc 7823

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Uc 7823 online

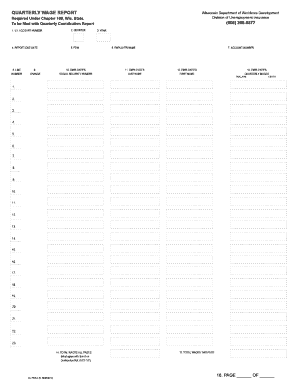

The Uc 7823 form is a critical document required by the Wisconsin Department of Workforce Development for all employers covered under the Unemployment Insurance Law. This guide provides step-by-step instructions on how to complete the form online efficiently.

Follow the steps to fill out the Uc 7823 online.

- Click ‘Get Form’ button to initiate the process and access the form in the editor.

- Begin by entering your U.I. account number in the designated field. This number is specific to your business and is crucial for tracking your submissions.

- Next, select the appropriate quarter for your reporting period, indicated by numbers 1 through 4.

- Input the year within which the quarter falls using the last two digits of the year.

- Provide the report due date for the quarterly wage report.

- Enter your Federal Employer Identification Number (FEIN) to identify your business for tax purposes.

- Fill in your employer name, ensuring that it matches your registered business name.

- Type your 14-digit account number in the specified location.

- If your form is preprinted with employee details, review and note any changes needed by marking 'Change' and indicating the corrections.

- For employee social security numbers, input them according to the provided format. If an employee lacks a number, indicate their name and wages.

- Record the employee's last name in capital letters without punctuation.

- Add the employee's first name, also in capital letters, omitting any middle initials.

- Document total quarterly wages paid to each employee, using a decimal format for cents.

- Summarize total wages across all pages. Ensure this matches the amount reported in the corresponding section of the Quarterly Contribution Report.

- Calculate and enter total wages specifically for the information listed on the current page.

- Indicate the page number and total number of pages for your submission.

- Once you have filled out the form, review it for accuracy and completeness before saving your changes, downloading, printing, or sharing the completed form.

Complete your Uc 7823 form online today to maintain compliance with filing requirements.

The federal withholding is 10% of the weekly amount payable, and the state withholding is 5% of the weekly amount payable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.