Loading

Get 2011 Do Not Mail To Alabama Dept. Of ... - Fileyourtaxes .com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

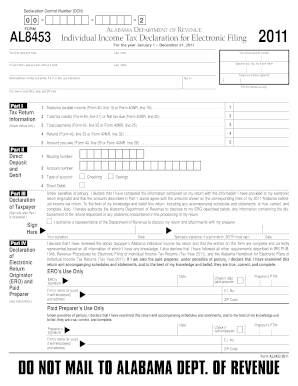

How to fill out the 2011 DO NOT MAIL TO ALABAMA DEPT. OF ... - FileYourTaxes .com online

This guide provides step-by-step instructions on how to complete the 2011 DO NOT MAIL TO ALABAMA DEPT. OF ... - FileYourTaxes .com form online. Follow these easily understandable directions to ensure accurate filling and submission.

Follow the steps to successfully complete your tax declaration form.

- Press the ‘Get Form’ button to access the document and view it in an editable format.

- Begin by entering your personal information in the designated fields. This includes your first name, middle initial, last name, and social security number. If filing jointly, enter your spouse's information as well.

- Fill out your home address, including city, state, and ZIP code. If you have a P.O. Box, follow the specific instructions provided in the document.

- In Part I, input your Alabama taxable income, total tax liability, total payments, refund amount, and any pending payments in the respective fields. Write amounts in whole dollars only.

- Move to Part II to provide details for direct deposit or debit. Enter your routing number, account number, and indicate the type of account you are using.

- Review your entries carefully, ensuring all information is accurate. Once verified, you or your spouse (if filing jointly) must sign the declaration of taxpayer section.

- If applicable, the paid preparer or Electronic Return Originator (ERO) must also complete their sections, ensuring their information and signatures are provided.

- Finally, save your changes, download the filled document, and consider printing it for your records. If necessary, share the completed form with your tax preparer.

Complete your documents online today for a seamless filing experience.

Two of our top picks for best tax software, H&R Block and TurboTax, offer free tax filing for very simple tax situations, regardless of your income level. Credit Karma Tax also has completely free federal and state tax filing with no income restrictions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.