Loading

Get City Of Grand Rapids Form Gr1040 N

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the City Of Grand Rapids Form GR-1040 N online

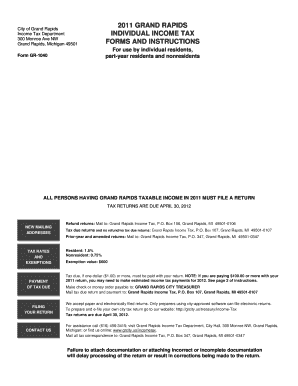

The City Of Grand Rapids Form GR-1040 N is essential for reporting income tax for individuals, including residents, part-year residents, and nonresidents. This guide will provide you with a clear, step-by-step approach to accurately filling out the form online.

Follow the steps to effectively complete your GR-1040 N form online.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- Enter your personal information including your name, address, and Social Security number. Make sure this matches the information on your attached W-2 forms.

- Indicate your residency status by marking the appropriate box for Resident, Nonresident, or Part-Year Resident. This status affects your tax obligations.

- Fill out your income details, including wages, pensions, and other relevant income sources. Attach any necessary schedules supporting these amounts.

- Calculate your total income by adding all applicable income and documenting any deductions based on the specific instructions provided.

- Complete the Exemptions Schedule by entering any applicable exemptions for yourself and dependents.

- Accumulate your total deductions and calculate your taxable income by subtracting deductions from total income.

- Determine your tax by multiplying your taxable income by the appropriate tax rate based on your residency status.

- Review all entries for accuracy, then save your progress. You may download, print, or share the completed form as needed.

Take the next step and start completing your City Of Grand Rapids Form GR-1040 N online now!

In most cases, if you don't live in New York City you aren't required to pay New York City personal income tax. ... However, if you're an employee of New York City, you may be required to file returns and pay taxes directly to the city finance department.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.