Loading

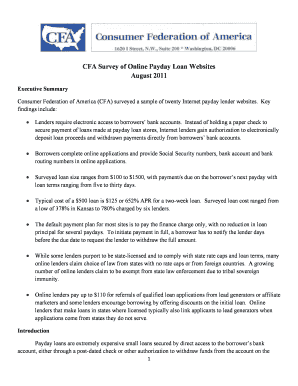

Get Consumer Federation Of America (cfa) Surveyed A Sample Of Twenty Internet Payday Lender Websites

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Consumer Federation Of America (CFA) Surveyed A Sample Of Twenty Internet Payday Lender Websites online

This guide provides clear instructions on effectively completing the Consumer Federation Of America (CFA) survey for a selection of twenty Internet payday lenders. It aims to assist users in navigating the online form with confidence.

Follow the steps to complete the CFA payday lender survey online.

- Click ‘Get Form’ button to obtain the survey form and open it in your preferred editor.

- Begin by reading the introductory instructions thoroughly to understand the purpose of the survey. This ensures that you provide relevant and accurate information.

- Fill out the personal identification section. You will need to enter basic details such as your name, contact information, and any other required identifiers.

- Provide details concerning your experience with internet payday lenders. Be specific about the lenders you interacted with and include their websites as necessary.

- Detail the methods you utilized to apply for loans. This may include whether you applied directly on the lender’s website, through a third party, or another method.

- When prompted, disclose any financial information relevant to the lender interactions, such as loan amounts taken, costs incurred, and repayment terms.

- Review your form carefully for accuracy and completeness before submission to minimize errors.

- Once you are satisfied with your entries, save the form. You may then choose to download, print, or share it as needed.

Start completing the CFA survey online today to share your experiences with internet payday lenders.

Payday loans can turn a short-term need for emergency cash into a long-term, unaffordable cycle of high-interest loans that you cannot repay. It is hard to both repay a payday loan and keep up with normal living expenses, so payday loans often force borrowers to take out another high-interest loan, over and over again.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.