Loading

Get Form 941 Ss 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 941 Ss 2012 online

Filling out the Form 941 Ss 2012 online can be a straightforward process when you follow a systematic approach. This guide will provide clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the Form 941 Ss 2012 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

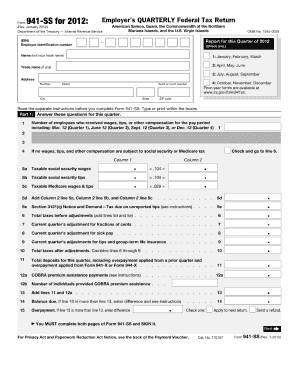

- Begin by reviewing the top section of the form where you will enter your employer identification number (EIN), the tax period, and the number of employees. Ensure accuracy as this information is crucial for processing.

- Proceed to the next section where you will report your wages and taxes withheld. Fill out the details on gross wages, tips, and other compensation, making sure to double-check your calculations for correct totals.

- Next, complete the area for tax liability. Indicate the amounts of Social Security tax and Medicare tax liability. It is important to use accurate figures to avoid discrepancies.

- Continue to the section where you will declare any adjustments if applicable. This includes any adjustments for sick pay or group-term life insurance that may apply.

- Finally, review all entries for correctness. Once you have verified that all information is accurate, you can save your changes, download, print, or share the form as needed.

Complete your Form 941 Ss 2012 online today for a hassle-free filing experience.

Both you and your employee must contribute 6.2% each paycheck for Social Security. Combined, you and your employee contribute 12.4%, which is the amount you multiply on lines 5a and 5b (0.124). Multiply any qualified sick leave wages (5a(i)) and qualified family leave wages (5a(ii)) by 0.062 for Social Security tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.