Loading

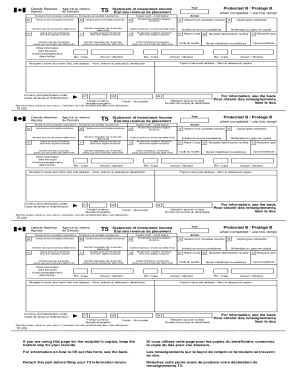

Get The T5 Statement Of Investment Income Tax Form Explained

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the T5 Statement of Investment Income tax form online

The T5 Statement of Investment Income tax form is essential for reporting various types of investment income, such as dividends from Canadian corporations. This guide provides clear, step-by-step instructions on how to complete this form online, ensuring accuracy and compliance with tax responsibilities.

Follow the steps to accurately complete your T5 form online.

- Click ‘Get Form’ button to obtain the form and open it in your document editor.

- Begin by entering the recipient's name and address. Ensure you write the last name first, followed by their first name.

- Enter the recipient's identification number and recipient type. If reporting for an individual, this is their social insurance number.

- Fill in the payer's name and address. This information identifies the source of the income payments.

- Report the actual amounts for eligible dividends in box 24 and other dividends in box 10. Be sure to distinguish between the two types.

- Input the taxable amounts for both eligible and non-eligible dividends in boxes 25 and 26 respectively.

- Include the relevant dividend tax credits in boxes 12 and 13, ensuring that you are accurately reflecting any credits to which the recipient is entitled.

- For any amounts in foreign currency, leave box 27 blank if reporting in Canadian dollars. Otherwise, detail the necessary currency information.

- Review all entered information for accuracy and completeness.

- Once completed, save changes to the document, and prepare to download, print, or share the form as needed.

Complete your T5 documents online today to ensure accurate reporting of investment income.

What's Included In the T5 Slip? Box 10: Actual amount of dividends other than eligible dividends. Box 11: Taxable amount of dividends other than eligible dividends. Box 12: Dividend tax credit for dividends (excluding eligible) Box 13: Interest income from Canadian sources. Box 14: Other income from Canadian sources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.