Loading

Get 990 Il Ag Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 990 Il Ag Form online

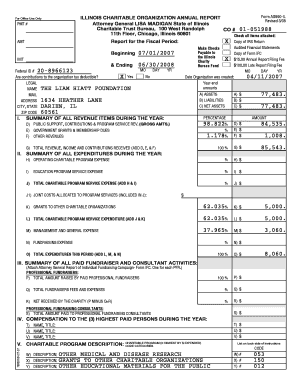

Filling out the 990 Il Ag Form is an essential process for charitable organizations in Illinois, ensuring compliance and transparency. This guide provides comprehensive, step-by-step instructions to assist users in completing the form online.

Follow the steps to successfully complete the 990 Il Ag Form online.

- Click the ‘Get Form’ button to obtain the 990 Il Ag Form and access it in your online editor.

- Begin filling out the organization’s legal name and mailing address in the designated fields. Make sure to include the city, state, and ZIP code.

- Indicate the fiscal year being reported by entering the beginning and ending dates of the fiscal period.

- Provide the federal ID number and state whether contributions to the organization are tax deductible by selecting ‘Yes’ or ‘No’.

- Enter the summary of revenue items, detailing amounts for assets, liabilities, and net assets in the respective fields.

- Fill out the summary of expenditures for the year, including all applicable expenses related to charitable programs.

- Complete the section for paid fundraiser and consultant activities, including amounts raised and paid respectively.

- List the three highest paid individuals during the year with their names and titles.

- Describe the charitable programs, including any relevant code categories and expenditure amounts.

- Review all answers, ensuring all questions about court actions, financial interests, and fundraising activities are answered.

- Sign and date the form in the provided sections, ensuring that all necessary individuals have completed their declarations.

- Finally, save your changes, then download, print, or share the completed form as required.

Begin completing your 990 Il Ag Form online now.

$15.00 Filing Fee, Check made payable to the "Illinois Charity Bureau Fund". b. Copy of the Federal Returns for the last three years (IRS Form 990 and IRS Form 990PF), if filed or if no Federal Returns were filed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.