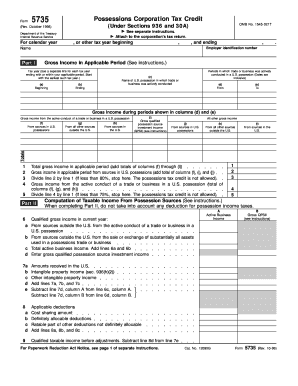

Get Form 5735 (rev. October 1998). Possessions Corporation Tax Credit (under Sections 936 And 30a)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:Tax, legal, business as well as other electronic documents require a top level of compliance with the law and protection. Our forms are regularly updated in accordance with the latest amendments in legislation. Additionally, with us, all the data you provide in your Form 5735 (Rev. October 1998). Possessions Corporation Tax Credit (Under Sections 936 And 30A) is protected against leakage or damage by means of cutting-edge file encryption.

The following tips will help you complete Form 5735 (Rev. October 1998). Possessions Corporation Tax Credit (Under Sections 936 And 30A) easily and quickly:

- Open the template in the feature-rich online editing tool by clicking on Get form.

- Fill out the necessary fields that are yellow-colored.

- Hit the arrow with the inscription Next to move on from box to box.

- Use the e-signature tool to e-sign the form.

- Put the relevant date.

- Read through the whole e-document to be sure that you have not skipped anything.

- Hit Done and download the new document.

Our service allows you to take the whole procedure of completing legal papers online. As a result, you save hours (if not days or even weeks) and eliminate additional expenses. From now on, complete Form 5735 (Rev. October 1998). Possessions Corporation Tax Credit (Under Sections 936 And 30A) from your home, office, or even while on the go.

The foreign tax credit is a U.S. tax credit used to offset income tax paid abroad. U.S. citizens and resident aliens who pay income taxes imposed by a foreign country or U.S. possession can claim the credit.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.