Loading

Get Form 355

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 355 online

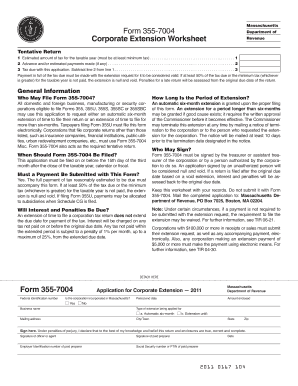

Filling out the Form 355 online is a straightforward process that allows corporations to request an extension for filing their corporate tax returns. This guide will provide you with detailed steps to complete the form accurately and efficiently.

Follow the steps to fill out the Form 355 online with ease.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the federal identification number of the corporation in the designated field.

- Indicate whether the corporation is incorporated in Massachusetts by selecting 'Yes' or 'No'.

- Provide the period end date for the corporation's taxable year.

- Fill in the business name of the corporation as it appears on official documents.

- Select the type of extension being applied for by checking the box for either 'Automatic six-month' or 'Extension until:'.

- Enter the mailing address, including city or town, state, and zip code.

- Sign the application in the designated area, confirming that the information provided is true and correct.

- If applicable, have the paid preparer sign and input their employer identification number and social security number or PTIN.

- Review all entered information for accuracy before proceeding.

- Save changes, and then download, print, or share the completed form as needed.

Complete your Form 355 online today for a smoother filing experience.

A business corporation will only file a separate Form 355 or 355S to calculate its non-income measure of excise tax, if its year ends at a different time than the common year used to determine the combined group's income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.