Loading

Get 2011 Form Mo 1040

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Form Mo 1040 online

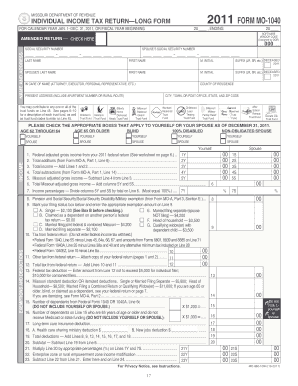

Filling out the 2011 Form Mo 1040 online is an essential step for individuals seeking to submit their Missouri income tax returns efficiently. This guide will provide clear instructions for completing each section of the form, ensuring users have the assistance they need throughout the process.

Follow the steps to complete your 2011 Form Mo 1040 online with ease.

- Press the ‘Get Form’ button to access the 2011 Form Mo 1040, allowing you to begin the process of filling it out.

- Fill in your name and address information in the designated fields at the beginning of the form. Ensure all details are accurate to avoid issues with your submission.

- Enter your Social Security number and your spouse’s Social Security number, if applicable. This information is essential for identification purposes.

- Indicate whether you are filing an amended return by checking the appropriate box if you are making changes to a previously submitted form.

- Complete the income section by providing your federal adjusted gross income as reported on your 2011 federal return, along with any additions and subtractions as needed.

- Fill out exemptions and deductions by marking your filing status and entering the corresponding amount based on your situation. Ensure to check any applicable boxes related to age or disability.

- Proceed to calculate your taxable income based on the deductions you've claimed, ensuring all calculations are accurate.

- Complete the tax section by determining the amount owed based on your taxable income, following the relevant tax tables provided in the instructions.

- Enter any payments or credits that apply, including Missouri tax withheld, estimated tax payments, and any applicable tax credits.

- After reviewing all entries for accuracy, save your changes and make sure to download a copy for your records. You may also print or share the completed form as needed.

Start filling out your 2011 Form Mo 1040 online today to ensure a smooth and timely submission.

Related links form

The Individual Income Tax Return (Form MO-1040) is Missouri's long form. It is a universal form that can be used by any taxpayer. If you do not have any of the special filing situations described below and you choose to file a paper tax return, try filing a short form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.