Loading

Get Ca Schedule D 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ca Schedule D 1 online

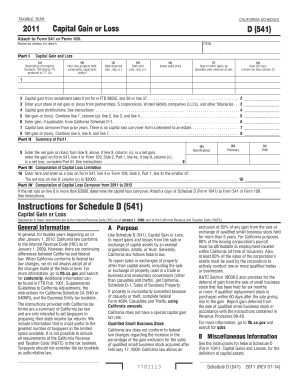

This guide provides clear, step-by-step instructions for completing the California Schedule D 1 online. Whether you are experienced or new to tax forms, this resource will support you in accurately reporting your capital gains and losses.

Follow the steps to effectively fill out your Ca Schedule D 1.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name as it appears on your tax return. Include your Federal Employer Identification Number (FEIN) if applicable.

- In Part I, list the description of the property you sold or exchanged. Be specific in detailing each asset.

- Indicate how the property was held. This may be as a community property, separately, or jointly held.

- Provide the date the property was acquired. Use the format month, day, year.

- Next, enter the date the property was sold in the same format.

- Document the gross sales price from the transaction. This is the total amount received from the sale.

- Enter the cost or other basis, adjusted, plus the expense of sale. This should include any expenses directly associated with the sale.

- Calculate the gain or loss by subtracting the cost in the previous step from the gross sales price.

- Follow through with lines 2-8 by reporting installment sale gains, net gains from partnerships, and gain distributions as needed.

- Finally, once all sections are completed and reviewed for accuracy, save your changes, download, print, or share the form as required.

Complete your Ca Schedule D 1 online to ensure timely and accurate tax reporting.

What are the differences between Schedule D and Form 4797? ... Generally, a Schedule D is used to report personal gains, while Form 4797 is used to report gains from the sale of property that had a business use.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.