Loading

Get Fcatb Org Fillable Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Fcatb Org Fillable Forms online

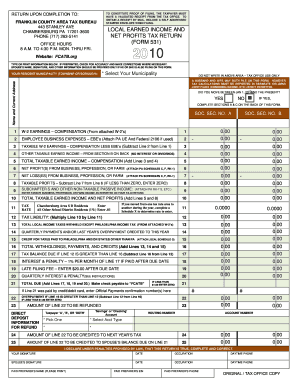

Filling out the Fcatb Org Fillable Forms online can simplify your local earned income and net profits tax return process. This guide will walk you through the necessary steps to complete the form effectively and accurately.

Follow the steps to fill out the Fcatb Org Fillable Forms online.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Type or print the required information in the fields provided. If the form is preprinted, check all entries for accuracy and make any necessary corrections.

- Indicate your resident municipality by selecting your township or borough from the drop-down menu.

- If filing jointly, ensure that both you and your partner's names, signatures, and relevant information are included in the appropriate sections. Joint filing requires separate columns for each individual's income calculations.

- If you moved within the tax year, answer the moving question and complete sections A & C on the back of the form as instructed.

- Enter your W-2 earnings and any employee business expenses in the designated fields. Attach necessary forms, such as the PA UE and Federal 2106, if applicable.

- Calculate your taxable earned income by following the provided calculations for sections on net profits and other taxable income.

- Complete the tax liability section by multiplying your taxable profits by the corresponding tax rate.

- Enter any local income taxes withheld and any credits for taxes paid to other jurisdictions.

- After finishing the form, save your changes and utilize the options to download, print, or share the document as needed.

Start filling out your forms online today for a simpler tax return experience.

The postal address is: HM Revenue and Customs – VAT Written Enquiries Team, Alexander House, 21 Victoria Avenue, Southend on Sea, SS99 1BD. CIS enquiries: telephone 0300 200 3210 or textphone 0300 200 3219. Lines are open from 8am to 8pm Monday to Friday and 8am to 4pm on Saturday.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.