Loading

Get Chase 1099 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Chase 1099 Form online

Filling out the Chase 1099 Form can seem daunting, but with clear guidance, it becomes a straightforward process. This guide aims to provide you with step-by-step instructions to help you accurately complete the form online.

Follow the steps to accurately fill out the Chase 1099 Form online.

- Click 'Get Form' button to obtain the form and open it in your editor.

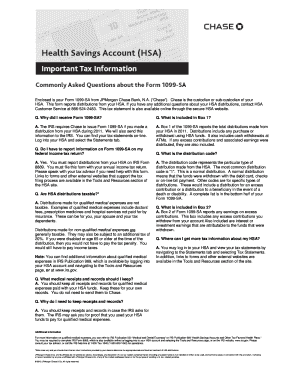

- Review Box 1, which includes the total distributions made from your health savings account (HSA). Ensure the amounts match your records for purchases or withdrawals made during the tax year.

- Check Box 2 for any earnings on excess contributions, as it reflects any interest or investment earnings related to funds withdrawn from your HSA.

- Locate the distribution code, also found on the form, to indicate the type of distribution made. Note that a normal distribution is indicated by the code '1'.

- Keep records of your qualified medical expenses and any receipts related to HSA transactions, as these may be needed for verification by the IRS.

- Once all sections are filled accurately, save your changes and choose from options to download, print, or share the completed form as needed.

Begin the process of completing your Chase 1099 Form online now.

Related links form

If you have not received an expected 1099 by a few days after that, contact the payer. If you still do not get the form by February 15, call the IRS for help at 1-800- 829-1040. In some cases, you may obtain the information that would be on the 1099 from other sources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.