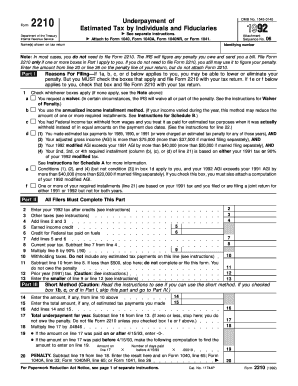

Get 1992 Form 2210. Underpayment Of Estimated Tax By Individuals And Fiduciaries

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:The times of frightening complicated tax and legal forms are over. With US Legal Forms the whole process of submitting legal documents is anxiety-free. A powerhouse editor is directly close at hand giving you multiple beneficial instruments for submitting a 1992 Form 2210. Underpayment Of Estimated Tax By Individuals And Fiduciaries. The following tips, with the editor will guide you with the whole procedure.

- Hit the Get Form button to begin filling out.

- Turn on the Wizard mode in the top toolbar to have extra pieces of advice.

- Fill in each fillable field.

- Make sure the information you add to the 1992 Form 2210. Underpayment Of Estimated Tax By Individuals And Fiduciaries is updated and correct.

- Include the date to the template using the Date option.

- Click on the Sign icon and make a signature. Feel free to use three available options; typing, drawing, or capturing one.

- Double-check each field has been filled in correctly.

- Click Done in the top right corne to save and send or download the form. There are various choices for receiving the doc. An attachment in an email or through the mail as a hard copy, as an instant download.

We make completing any 1992 Form 2210. Underpayment Of Estimated Tax By Individuals And Fiduciaries simpler. Use it now!

The Underpayment of Estimated Tax by Individuals Penalty applies to individuals, estates and trusts if you don't pay enough estimated tax on your income or you pay it late. The penalty may apply even if we owe you a refund.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.