Loading

Get 2014 Usindividual Tax Return Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2014 Usindividual Tax Return Form online

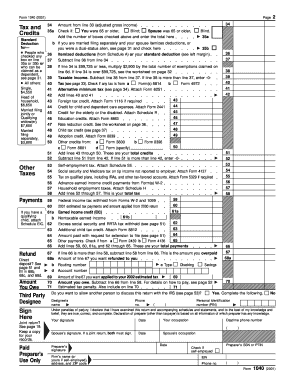

Filling out the 2014 Usindividual Tax Return Form online can seem daunting, but with a clear guide, you can navigate it easily. This guide provides step-by-step instructions to help users accurately complete the form.

Follow the steps to successfully fill out your tax return online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in your personal information. Enter your first and last name, social security number, and home address, ensuring all provided details are accurate.

- Select your filing status by checking only one box that best describes your situation: single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Complete the exemptions section by indicating whether you and your spouse claim yourselves as exemptions and listing any dependents along with their details, including social security numbers and relationships.

- Report your income accurately. Attach any required Forms W-2 and/or 1099 corresponding to your income sources. List wages, interest, dividends, and any alimony received.

- Calculate your adjusted gross income by subtracting deductions such as student loan interest, moving expenses, and self-employed health insurance from your total income.

- Determine your tax and credits. Enter the applicable standard deduction or itemized deductions. Be sure to apply any credits for child and dependent care expenses.

- Review your payments, including federal tax withheld and any estimated tax payments made throughout the year. Summarize total credits to ensure accuracy.

- Final calculations: determine any refund due to you or amount owed by subtracting total payments from total tax. If applicable, designate your refund preferences such as direct deposit.

- Sign and date your form, ensuring both partners sign if filing jointly. Keep a copy for your records and proceed to submit the form electronically.

Begin filling out your documents online today to stay organized and compliant with your tax obligations.

Prior Year Returns – MeF allows filing of prior year 1040 returns. As a new tax form type is added to the MeF platform, tax returns will be accepted for the current tax year only. As subsequent tax years are added to the system, MeF will accept the current tax year and two prior tax years.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.