Loading

Get Oklahoma Tax Commission Ow 9 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Oklahoma Tax Commission OW-9 Form online

Filling out the Oklahoma Tax Commission OW-9 Form online is a straightforward process that ensures accurate reporting of employer withholding taxes. This guide will provide step-by-step instructions to help you complete each section of the form with confidence.

Follow the steps to complete the OW-9 Form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

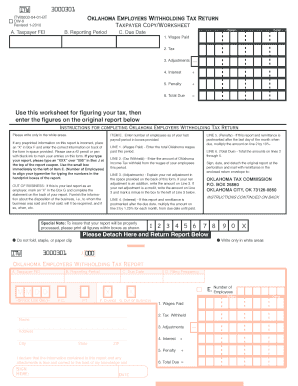

- In Section A, enter the taxpayer's Federal Employer Identification (FEI) number. This is crucial for identifying your business in relation to tax obligations.

- In Section B, input the reporting period for the wages paid. This indicates the timeframe covered by the current report.

- For Section C, note the due date for submitting the report. This ensures timely filing and helps avoid late fees.

- Moving to Section D, select your filing frequency which could be monthly or quarterly based on your previous filings.

- In Section E, enter the total number of employees for the last payroll period within the designated boxes.

- Proceed to Line 1, where you will list the total wages paid during the reporting period. This information is critical for calculating tax withheld.

- On Line 2, indicate the total amount of Oklahoma income tax withheld from employee wages during the reporting period.

- Line 3 is for adjustments; if there are any net adjustments, explain them in the space provided at the back of the form.

- For Line 4, if applicable, calculate interest due by multiplying the amount on Line 2 by 1.25% for each month that the report is late.

- On Line 5, record any penalties incurred if your report is submitted after the deadline. This is calculated at 10% of the tax withheld.

- Finally, calculate the total due on Line 6 by summing lines 2 to 5. This final amount reflects your total employer tax obligation.

- Sign and date the form under the declaration section, confirming the information is true to the best of your knowledge.

- Detach the original report at the perforation and retain the worksheet for your records. Ensure to mail the report to the address provided: Oklahoma Tax Commission, P.O. Box 26860, Oklahoma City, OK 73126-0860.

- Once complete, save changes, and consider downloading or printing the form for your records.

Don't hesitate — complete your Oklahoma Tax Commission OW-9 Form online today for streamlined tax filing.

Related links form

Is the Oklahoma Tax Commission Open? The lobby of our Oklahoma City main office (2501 N Lincoln Blvd, Oklahoma City, OK) is open for services to taxpayers by appointment only. You do not need to call ahead to receive an appointment. When you arrive, you'll be checked in outside of our entrance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.