Loading

Get Revenue Procedure 1999-1 - Letter Rulings, Determination Letters, And Information Letters. Issued

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Revenue Procedure 1999-1 - Letter Rulings, Determination Letters, And Information Letters. Issued online

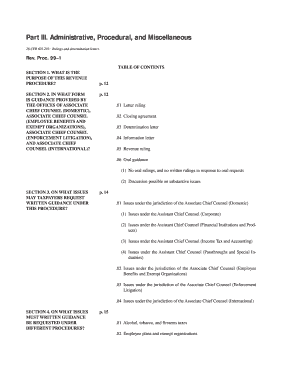

Navigating the process of obtaining letter rulings, determination letters, and information letters can be complex. This guide will provide clear instructions to assist you in correctly completing the Revenue Procedure 1999-1, ensuring that you submit all necessary information online.

Follow the steps to successfully complete your letter ruling request.

- Click ‘Get Form’ button to access the Revenue Procedure 1999-1 form online and open it in the editor.

- Begin by filling out your taxpayer information section which includes your name, address, and identification number as required. Make sure to check section 1 for purpose clarity.

- Proceed to the 'Statement of Facts' section. Include a detailed account of the facts related to your request, specifying the business reasons for the transaction as outlined in section 8.01.

- In the 'Ruling Requested' section, clearly state the ruling you are seeking, maintaining the desired language from the Service to facilitate precision.

- Compile a 'Statement of Law' supporting your request; include references to relevant authorities and any pending legislation that may impact the transaction as noted in section 8.01.

- Add an 'Analysis' section where you discuss both the facts presented and relevant law, ensuring all aspects align with the government's position.

- For procedural requirements, check boxes indicating compliance with items including if the same issue has appeared in earlier filings or if similar requests have been submitted previously, as described in sections 8.01(4) and 8.01(5).

- Complete the checklist provided in Appendix C to ensure that all necessary items are addressed, confirming that your request is fully compliant and ready for submission.

- Submit your request online with all necessary signatures and ensure your payment for the user fee is included or properly noted for reduced fee applicants as outlined in section 15.

Take charge of your tax rulings today by completing your document request online!

Letter Rulings are similar to Revenue Rulings, but they are relied upon as precedent only by the taxpayer to whom the ruling is issued. The name and other identifying information concerning the taxpayer requesting the P.L.R. is redacted. Private Letter Rulings are not officially published in a reporter.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.