Loading

Get 1065 Ct 1120 Sirr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1065 Ct 1120 Sirr online

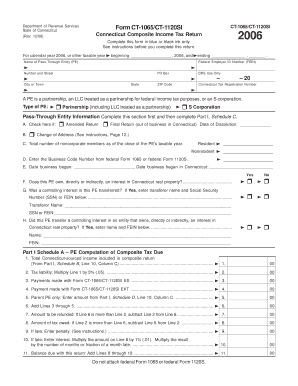

Filling out the 1065 Ct 1120 Sirr, the Connecticut Composite Income Tax Return, can initially seem daunting. This guide aims to support users through each essential step, ensuring a smooth and efficient online filing process.

Follow the steps to successfully complete your filing process.

- Press ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Begin by completing the pass-through entity information section. Enter the name of the pass-through entity, the federal employer identification number (FEIN), address details, and Connecticut tax registration number.

- Indicate the type of pass-through entity by checking the appropriate box, selecting either 'Partnership' or 'S Corporation'.

- If applicable, check the boxes for amended return, final return, or change of address and provide the necessary details for each.

- Complete the total number of noncorporate members for residents and nonresidents, along with the business code number from the federal Form 1065 or Form 1120S.

- Record the date the business began and the date it commenced in Connecticut. Answer whether the entity owns any interest in Connecticut real property and provide details if a controlling interest has been transferred.

- Move on to Part I Schedule A, where you will calculate the composite tax due. Input the total Connecticut-sourced income and compute the tax liability by multiplying the income by 5%.

- Continue populating the required fields for payments made and amounts owed, ensuring accuracy before moving to the next section.

- Fill out Part I Schedule B, documenting members’ Connecticut-sourced income and corresponding tax liability. Ensure that all supplementary attachments are included if needed.

- Complete Part I Schedule C, recording all necessary income and loss details including business income, rentals, and dividends.

- If applicable, proceed to Parts II, III, IV, and V to disclose allocation and apportionment of income, member information, and Connecticut modifications, ensuring to attach additional documentation where needed.

- Final review: thoroughly check all entries, ensure no sections are missed and prepare to submit. You can then save changes, download, print, or share the completed form.

Take action now and complete your 1065 Ct 1120 Sirr form online expertly.

Filing Address: Also knows as the legal address, this is your primary place of business and it should match the address you have on file with the IRS as the company's physical location. This address is used when sending returns to taxing agencies.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.