Loading

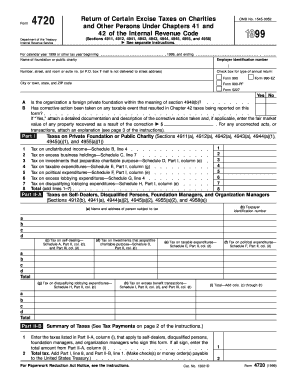

Get Form 4720 Return Of Certain Excise Taxes On Charities And Other Persons Under Chapters 41 And 42 Of

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4720 Return of Certain Excise Taxes on Charities and Other Persons Under Chapters 41 and 42 of online

Filling out the Form 4720 is critical for charities and other organizations to comply with the excise tax regulations under the Internal Revenue Code. This guide provides clear, step-by-step instructions to help you accurately complete the form online.

Follow the steps to successfully complete the Form 4720 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the relevant details for the tax year. Indicate the calendar year in the specified fields and ensure you complete the organization name and employer identification number.

- Select the applicable type of annual return by checking the corresponding box for Form 990, Form 990-EZ, Form 990-PF, or Form 5227.

- Answer the yes or no questions regarding the organization's status as a foreign private foundation and whether corrective actions have been taken. If applicable, provide the fair market value of any recovered property.

- Complete Part I by calculating the taxes on the private foundation or public charity. Fill in all details for each type of tax, ensuring to add up the totals for lines 1 through 7, which will provide you with line 8.

- Proceed to Part II-A to outline taxes on self-dealers and disqualified persons. Provide the name, address, and taxpayer identification number for each person subject to tax and list the applicable tax amounts.

- In Part II-B, record the total tax applicable to self-dealers, disqualified persons, and foundation managers. Ensure to sum these amounts accurately.

- When completing Schedules A through I, provide specific details about self-dealing acts, undistributed income, excess business holdings, and other relevant categories as outlined in each schedule.

- Once all sections are completed, carefully review the form for accuracy before finalizing your submission.

- Save changes to the completed form. You can download, print, or share it as needed to ensure it reaches the necessary parties.

Begin filling out your Form 4720 online to ensure compliance with excise tax regulations today.

Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.