Loading

Get Da Form 5329

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Da Form 5329 online

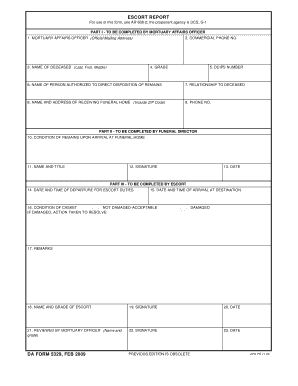

Filling out the Da Form 5329 online can streamline the process of documenting vital details related to the escort of remains. This guide provides a clear, step-by-step approach for users to accurately complete the form.

Follow the steps to effectively complete the form online.

- Press the 'Get Form' button to access the form and open it in your online editor.

- In Part I, enter the official mailing address of the mortuary affairs officer, including the commercial phone number and their grade. Record the name of the deceased, their DCIPS number, and the name of the person authorized to direct the disposition of remains along with their relationship to the deceased. Lastly, provide the name and address of the receiving funeral home, including the ZIP code and their phone number.

- Proceed to Part II, where the funeral director will document the condition of the remains upon arrival at the funeral home. They must also provide their name, title, date, and a signature to validate the section.

- Move to Part III, and enter the date and time of departure for escort duties, as well as the date and time of arrival at the destination. Specify the condition of the casket – if it is not damaged, select 'not damaged-acceptable.' If it is damaged, document the actions taken to resolve the issue.

- In this section, provide any additional remarks regarding the escort or condition of the remains. Enter the name and grade of the escort, followed by their signature and date.

- Finally, ensure that the mortuary officer reviews the form. Include their name, grade, signature, and the date of review.

- Once all sections are complete, save changes, and download or print the form as needed for your records.

Start completing your online forms today for efficient document management.

Across the top of the screen, click on Other tax situations. Scroll down to Additional Tax Payments. Click on Start / Revisit on Extra tax on Extra tax on early retirement withdrawals. The most common use of form 5329 is to waive exceptions to the 10% penalty for early withdrawal of a pension distribution.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.