Loading

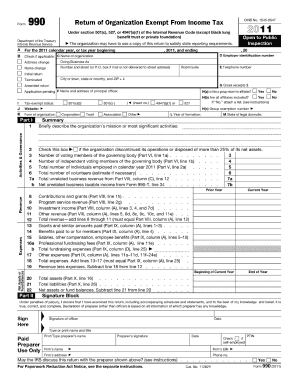

Get Under Section 501(c), 527, Or 4947(a)(1) Of The Internal Revenue Code (except Black Lung Benefit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Under Section 501(c), 527, Or 4947(a)(1) Of The Internal Revenue Code (except Black Lung Benefit online

This guide provides clear instructions for completing the Under Section 501(c), 527, or 4947(a)(1) form of the Internal Revenue Code online. Follow the steps outlined below to ensure your submission is accurate and compliant.

Follow the steps to effectively complete the form.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin filling out the form by entering your organization's name and address in the designated fields. Ensure that all information is accurate and matches official documents.

- Specify the applicable section of the Internal Revenue Code you are filing under: Section 501(c), Section 527, or Section 4947(a)(1). Provide any necessary documentation that supports your eligibility.

- Complete the financial information sections, including revenue, expenses, and assets. Make sure to use the latest financial statements to provide accurate data.

- Answer all questions relating to the purpose and activities of your organization. Be clear and concise to convey your mission effectively.

- Review your entries carefully for any errors or omissions. Properly cite any attachments or supplementary materials as necessary.

- Once your form is completely filled out and reviewed, save your changes. You can then download, print, or share the completed form as needed.

Start filling out your form online today to ensure timely submission and compliance.

Exempt purposes - Code section 501(c)(7) A club will not be recognized as tax exempt if its charter, by laws, or other governing instrument, or any written policy statement provides for discrimination against any person based on race, color, or religion.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.