Loading

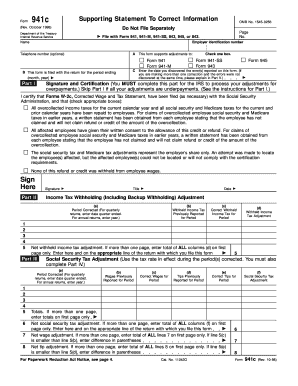

Get Form 941c (rev. October 1998). Supporting Statement To Correct Information

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 941C (Rev. October 1998). Supporting Statement To Correct Information online

Filling out the Form 941C is essential for correcting previously reported income, social security, and Medicare tax information. This guide will provide clear instructions to assist you in accurately completing this form online.

Follow the steps to fill out the Form 941C online.

- Click ‘Get Form’ button to access the form and open it for editing.

- Begin filling out the form by entering your employer identification number and optional telephone number. This information ensures that the IRS can identify your submission and reach you if needed.

- In part A, select the appropriate box corresponding to the form you are correcting, such as Form 941 or Form 943.

- In part B, indicate which return period you are correcting by entering the end month and year of that period.

- Enter the date you discovered the error(s) on line C. If multiple corrections are necessary, you can explain this in part V.

- Complete the signature and certification section. You must check at least one box if you are making adjustments for overpayments and sign this part to allow processing by the IRS.

- Proceed to part II to make income tax withholding adjustments. Report the total withheld income tax previously and correctly for the periods you are adjusting.

- In part III, input corrections for social security tax by entering previously reported wages and tips along with the correct figures for those periods.

- Move to part IV to address Medicare tax adjustments. Record the previously reported wages and tips alongside the accurate figures.

- In part V, if applicable, provide a detailed explanation of the adjustments being made. This is required if you are correcting multiple errors at different times.

- Finally, review all information for accuracy. You can then save your changes, download the completed form, print it, or share it as necessary.

Complete your Form 941C online today to ensure your tax information is accurate and up to date.

Amendments to a federal tax return are generally due within three years of the return's original or extended due date, and Form 941 is due by the last day of the month that follows the end of each quarter (i.e., Form 941 is due on April 30, July 31, October 31, and January 31).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.