Loading

Get Form 709 1983

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 709 1983 online

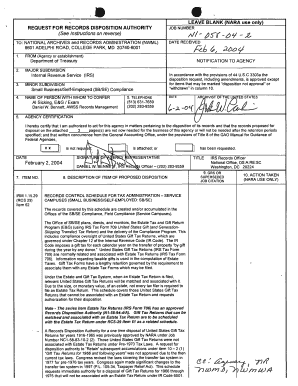

Filling out Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return, electronically can streamline the process of reporting gifts made during the tax year. This guide provides clear steps to assist users in completing the form accurately and efficiently online.

Follow the steps to fill out Form 709 online:

- Press the ‘Get Form’ button to access the Form 709 and open it in your designated editor. Ensure the document is displayed correctly before proceeding.

- Begin with Section 1, where you will need to provide your name, address, and taxpayer identification number. Make sure that all information is accurate and matches the records on file.

- In Section 2, list the gifts made during the tax year. For each gift, include detailed descriptions, the valuation method, and the fair market value of the items given.

- Proceed to Section 3, where you must indicate any prior gifts made in previous years that are relevant to the current filing. This includes descriptions and values that ensure proper reporting under tax laws.

- Complete Section 4 by checking any applicable boxes that relate to the generation-skipping transfer tax, if applicable. This section determines if the gifts fall under additional tax regulations.

- In Section 5, verify and sign the declaration, confirming that all information provided is true and complete. Ensure you date your signature correctly.

- Finally, once all sections are completed and double-checked for accuracy, save your changes, download a copy for your records, and print or share the completed Form 709 as necessary.

Start filling out your Form 709 online today to ensure timely and accurate submission!

The primary way the IRS becomes aware of gifts is when you report them on form 709. You are required to report gifts to an individual over $14,000 on this form. ... However, form 709 is not the only way the IRS will know about a gift. The IRS can also find out about a gift when you are audited.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.