Get Cdn.mutualofomaha.commutualofomahafoundationform 990-pf Return Of Private Foundation I ... - Mutual

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:Finding a legal expert, making an appointment and going to the business office for a personal meeting makes doing a Cdn.mutualofomaha.commutualofomahafoundationForm 990-PF Return Of Private Foundation I ... - Mutual from beginning to end exhausting. US Legal Forms allows you to rapidly make legally-compliant documents according to pre-created web-based blanks.

Prepare your docs within a few minutes using our straightforward step-by-step instructions:

- Get the Cdn.mutualofomaha.commutualofomahafoundationForm 990-PF Return Of Private Foundation I ... - Mutual you want.

- Open it using the cloud-based editor and start altering.

- Complete the blank areas; engaged parties names, places of residence and phone numbers etc.

- Customize the blanks with smart fillable fields.

- Put the day/time and place your e-signature.

- Simply click Done following twice-examining all the data.

- Save the ready-produced document to your device or print it out as a hard copy.

Swiftly create a Cdn.mutualofomaha.commutualofomahafoundationForm 990-PF Return Of Private Foundation I ... - Mutual without having to involve experts. We already have over 3 million people benefiting from our unique collection of legal documents. Join us right now and gain access to the #1 library of online blanks. Try it yourself!

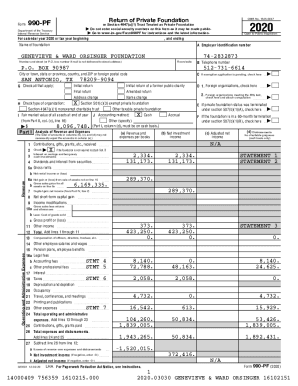

the year or not (including nonexempt private foundations, and nonexempt charitable trusts described in section 4947(a)(1) of the Code that are treated as private foundations), are required to file an annual return on Form 990-PF, Return of Private FoundationPDF.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.