Loading

Get Form 8396

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8396 online

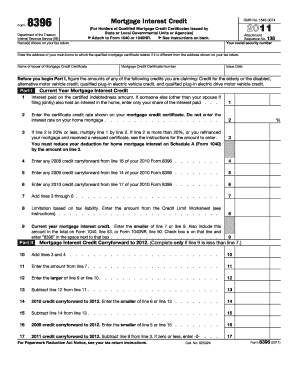

Form 8396 is designed to calculate the mortgage interest credit for eligible individuals who have received a qualified Mortgage Credit Certificate. This guide provides detailed, step-by-step instructions to assist you in filling out this form online, ensuring clarity and accuracy in your submission.

Follow the steps to efficiently fill out the Form 8396 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin with the top section where you need to input your name(s) as shown on your tax return, and your social security number. Ensure that the information is accurate as it will be used to file your tax return correctly.

- Enter the address of your main home associated with the qualified mortgage certificate, if different from the address on your tax return.

- Provide the name of the issuer of the mortgage credit certificate, along with the certificate number and issue date. This information is typically found on your certificate documentation.

- In Part I, calculate your current year mortgage interest credit. Enter the interest paid on the certified indebtedness amount on line 1. If applicable, ensure you only enter your share of interest paid if multiple parties are involved.

- Next, enter the certificate credit rate as indicated on your mortgage credit certificate on line 2. Remember, rates range between 10% and 50%.

- For line 3, if the certificate credit rate is more than 20%, multiply the figure in line 1 by the rate in line 2. Note the $2,000 maximum limit applies, which might require allocation among multiple parties if necessary.

- Continue to input any applicable carryforward credits from previous years on lines 4 to 6. Add these to compute your total on line 7.

- Complete line 8 by referencing the Credit Limit Worksheet. This helps ensure you stay within the limits set for your tax liability.

- On line 9, enter the smaller amount from line 7 or line 8. This amount should be also reported on your Form 1040, checking the applicable box and noting '8396' in the specified space.

- Proceed to Part II only if line 9 is less than line 7 to document any mortgage interest credit carryforward to future years.

- Once all fields are accurately filled, review your information. Save your changes, and choose to download, print, or share the completed form as necessary.

Take action now and fill out your Form 8396 online to ensure you receive the mortgage interest credit you deserve.

A Mortgage Credit Certificate (MCC) is a tax credit given by the IRS to low and moderate income homebuyers. ... The amount of the tax credit is equal to 20 percent of the mortgage interest paid for the tax year. The remaining 80 percent interest is still eligible to be used as a tax deduction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.