Loading

Get Net Income Statement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Net Income Statement Form online

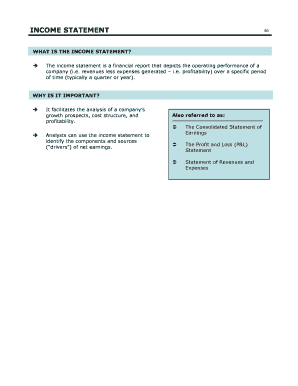

Filling out the Net Income Statement Form online is an essential step for understanding a company's profitability over a specific period. This guide will walk you through the various sections of the form, helping you accurately capture the necessary financial information.

Follow the steps to fill out the Net Income Statement Form effortlessly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the section for Net Revenues. This refers to the total dollar amount received for goods and services over the reporting period, which should include adjustments for returns or discounts.

- Next, provide the Cost of Goods Sold (COGS). This section requires you to input the direct costs of manufacturing products or procuring goods that were sold during the period.

- Calculate the Gross Profit by entering the net revenues minus COGS. This figure indicates the profitability of your core operations.

- Complete the Selling, General & Administrative (SG&A) section, which includes all operating costs that are not directly tied to production, such as administrative salaries and marketing expenses.

- Fill in the Research & Development (R&D) costs, which represent expenses directed towards the development of new products or procedures.

- Input the Earnings Before Interest, Taxes, Depreciation & Amortization (EBITDA) which is calculated as Gross Profit minus SG&A and R&D.

- Next, enter the Depreciation & Amortization values, which represent the cost allocation of fixed assets over time.

- Complete the Other Operating Expenses/Income section by including any minor costs or income not accounted for in previous sections.

- Calculate Earnings Before Interest & Taxes (EBIT) by subtracting Depreciation & Amortization from EBITDA.

- Enter Interest Expenses that detail costs related to the company’s indebtedness.

- Input any Interest Income derived from cash holdings or investments, which contributes to overall profitability.

- Document any Unusual or Infrequent Income/Expenses, such as gains from asset sales or restructuring costs.

- Specify the Income Tax Expense based on applicable tax laws.

- Finally, calculate Net Income by subtracting all relevant expenses, including taxes and interest, from EBIT.

- Before finalizing, ensure all sections of the form are completed thoroughly. Users can save changes, download, print, or share the form as needed.

Complete your Net Income Statement Form online today for a clearer financial overview.

Related links form

Net income (NI), also called net earnings, is calculated as sales minus cost of goods sold, selling, general and administrative expenses, operating expenses, depreciation, interest, taxes, and other expenses. ... This number appears on a company's income statement and is also an indicator of a company's profitability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.