Loading

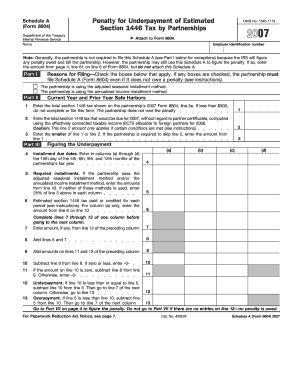

Get Schedule A (form 8804) Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule A (Form 8804) Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships online

Filling out the Schedule A (Form 8804) is an important task for partnerships to determine any penalties for underpayment of estimated section 1446 tax. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to fill out Schedule A (Form 8804) online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, check the boxes that apply to your partnership. If your partnership uses the adjusted seasonal installment method or the annualized income installment method, it must file Schedule A.

- In Part II, enter the total section 1446 tax shown on the partnership’s Form 8804, line 5e. If this amount is less than $500, there is no need to complete or file this form.

- Next, in Part II, line 2, enter the total section 1446 tax due for 2007 without regard to partner certificates, considering the effectively connected taxable income (ECTI) allocable to foreign partners for 2006, if applicable.

- Proceed to Part III, where you will enter the due dates for installments in columns (a) through (d), along with required installments and estimated section 1446 tax paid or credited for each period.

- Complete the calculations in Part III regarding underpayment and overpayment. Ensure to add necessary lines and correctly apply the underpayment calculations for each installment period.

- If your partnership has elected to use a schedule to expand certain lines, check the corresponding box in Part IV to reflect this in your calculations.

- In Parts IV through VI, calculate the required installments based on either the adjusted seasonal or annualized income installment methods, providing the appropriate figures for each applicable column.

- Finally, move to Part VII to figure the penalty for any underpayment, entering necessary dates and calculations to assess the total penalty to report on Form 8804.

- Review all entries, making any necessary changes, and then save your changes, download, print, or share the completed form as needed.

Complete your Schedule A (Form 8804) online today to ensure all tax obligations are met accurately.

Form 8804 Penalties A penalty may be imposed for failure to file Form 8804 when due (including extensions). The penalty for not filing Form 8804 when due is usually 5% of the unpaid tax for each month or part of a month the return is late, but not more than 25% of the unpaid tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.