Loading

Get It 203 Fill In

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-203 Fill In online

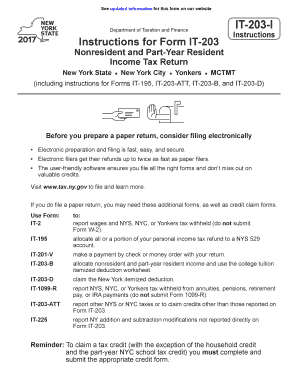

This guide provides a comprehensive overview of how to complete the IT-203 Fill In form online. Designed for users with various levels of tax experience, it breaks down each section in a clear, accessible manner.

Follow the steps to successfully complete your IT-203 Fill In form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete the taxpayer information section including name, address, and Social Security number. If applicable, enter your spouse's information if filing jointly.

- Select your filing status and provide any required information specific to your filing situation.

- Calculate your New York adjusted gross income (AGI) by following the guidelines for additions and subtractions as provided in the instructions.

- Determine your standard or itemized deduction, and enter the chosen amount on the form.

- Compute your tax based on the New York State tax rate schedule and input the calculated tax owed on the form.

- Enter any payments or credits on the designated lines and ensure you complete the necessary forms for any additional contributions or credits.

- Review all entries for accuracy, ensuring that all required sections have been completed.

- Finish your return by signing and dating it, ensuring that all necessary documents are included before submission.

- Submit your completed form according to the guidance provided regarding filing methods.

To make tax filing easier, complete your IT-203 Fill In form online now.

As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.