Loading

Get Irs 1040 - Schedule H 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule H online

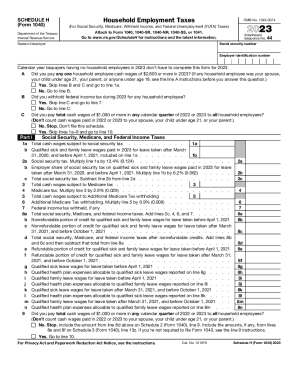

This guide provides clear and supportive instructions on how to complete the IRS 1040 - Schedule H online. By following these steps, users will be able to correctly report household employment taxes and ensure compliance with IRS requirements.

Follow the steps to accurately complete your Schedule H online.

- Click ‘Get Form’ button to access the IRS 1040 - Schedule H form and open it in the online editor.

- Begin by entering your social security number and the name of your employer at the top of the form. Ensure that the employer identification number is also completed if applicable.

- Answer the initial eligibility questions regarding whether you paid any household employee cash wages of $2,600 or more in 2023. If yes, skip lines B and C and proceed to line 1a.

- If you did not meet the criteria in step 3, answer line B regarding federal income tax withholding for household employees. Respond appropriately based on whether you withheld any federal income tax.

- Complete line C by determining if total cash wages of $1,000 or more were paid in any calendar quarter of 2022 or 2023 to all household employees. If no, do not file this schedule.

- For Part I, complete line 1a by entering total cash wages subject to social security tax. Follow up with any applicable amounts on subsequent lines, ensuring calculations are accurate for social security and Medicare taxes.

- In line 8a, combine social security, Medicare, and federal income taxes to determine the total. Follow through with the remaining questions and lines to capture any additional credits or adjustments.

- If required, proceed to Part II to answer questions about federal unemployment tax. Complete Sections A or B based on your previous answers regarding state contributions.

- In Part III, finalize the total of household employment taxes. If you are required to file Form 1040, ensure that everything is summarized correctly as per IRS instructions.

- Finish by completing Part IV with your address and signature if required. Ensure all information is accurate before submitting the form.

- Once completed, users can save their changes, download the form for personal records, print it, or share it as needed.

Complete your IRS 1040 - Schedule H online to ensure proper filing and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Use Schedule H (Form 1040) to report household employment taxes if you paid cash wages to a household employee and the wages were subject to social security, Medicare, or FUTA taxes, or if you withheld federal income tax.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.