Loading

Get Uncle Fed Irs Forms 2012 F941 Schedule B

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Uncle Fed Irs Forms 2012 F941 Schedule B online

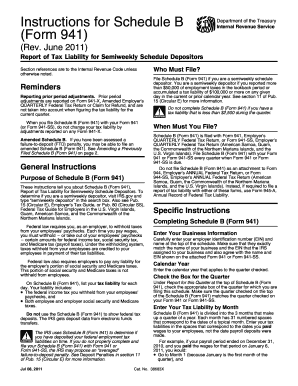

Filling out the Uncle Fed Irs Forms 2012 F941 Schedule B can seem complex, but with the right guidance, it can be manageable. This guide provides clear, step-by-step instructions to assist users in completing this important tax document accurately.

Follow the steps to effectively fill out Schedule B online.

- Click ‘Get Form’ button to acquire the necessary form and open it in your preferred editor.

- Enter your business information at the top of Schedule B, including your employer identification number (EIN) and business name, ensuring they match the IRS records.

- Specify the calendar year for the tax quarter you are reporting.

- Mark the appropriate box at the top of Schedule B that corresponds to the quarter for which you are filing.

- In the designated spaces, report the tax liability for each day in the quarter based on the dates your wages were paid, not the payroll deposit dates.

- For the total tax liability for the quarter, sum your monthly tax liabilities from each month within that quarter.

- Once you have completed all sections, review the information for accuracy before proceeding.

- Save your changes, download the completed form, print it for your records, or share it as needed.

Complete your Uncle Fed Irs Forms online to ensure timely and accurate tax reporting.

For each month or partial month you are late filing Form 941, the IRS imposes a 5 percent penalty, with a maximum penalty of 25 percent. This penalty is a percentage of the unpaid tax due with the return. ... The IRS might waive late filing penalties if you have reasonable cause for filing late.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.