Loading

Get Fcps Net Taxes

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fcps Net Taxes online

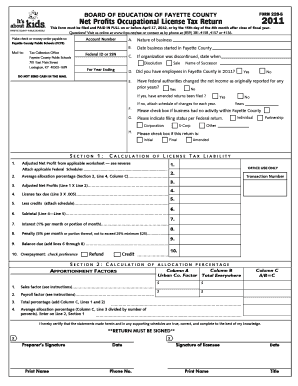

Filling out the Fcps Net Taxes form online is essential for maintaining compliance with local tax regulations. This guide will provide you with step-by-step instructions to help you navigate each section of the form seamlessly.

Follow the steps to complete the Fcps Net Taxes form

- Click ‘Get Form’ button to obtain the form and access it in the online editor.

- Enter your account number, if applicable. This information is essential for identifying your tax account.

- Input your federal ID or Social Security Number in the designated field to ensure accurate reporting.

- Provide the nature of your business. This helps categorize the type of activities your business engages in.

- Indicate the date your business started operations in Fayette County. This timeline is vital for tax assessments.

- If your business has been discontinued, specify the dissolution date to clarify its status.

- Confirm whether you had employees in Fayette County during the reporting year by selecting yes or no as applicable.

- State whether federal authorities have made changes to your net income for any prior years, and if so, mention if amended returns have been filed.

- Check the box if your business had no activity within Fayette County during the reporting period.

- Indicate your filing status per your federal return—options typically include corporation, S-Corp, or partnership.

- Complete the calculation section. Begin with listing the adjusted net profit from the applicable worksheet as requested on the form.

- Calculate the license tax due by multiplying your adjusted net profits by the specified rate.

- Deduct any credits applicable to your business from your calculated license tax to determine your subtotal.

- Include any interest and penalties incurred, if applicable, to calculate the final balance due.

- Review all fields for accuracy, then proceed to save your changes, download the completed form, print, or share it as required.

Complete your Fcps Net Taxes online to ensure timely compliance with your tax obligations.

Related links form

Kentucky's individual income tax law is based on the Internal Revenue Code in effect as of December 31, 2021. The tax rate is five (5) percent and allows itemized deductions and certain income reducing deductions as defined in KRS 141.019.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.