Loading

Get Uia 1581 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Uia 1581 form online

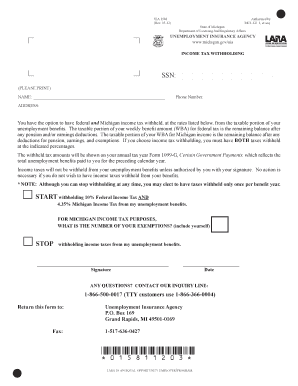

Filling out the Uia 1581 form online is an essential step for managing your income tax withholding on unemployment benefits in Michigan. This guide will walk you through the process, ensuring you navigate each section effectively.

Follow the steps to easily complete the Uia 1581 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your Social Security Number (SSN) in the designated field. Ensure that the number is accurate and matches your records.

- Provide your full name in the name section as it appears on your official documentation.

- Enter your phone number to ensure the agency can reach you if necessary.

- Complete your address in the address section, including street, city, state, and ZIP code.

- Choose whether to start withholding federal and Michigan income taxes from your unemployment benefits. You must authorize both if you decide to proceed.

- If opting for withholding, indicate the number of exemptions you are claiming for Michigan income tax purposes, including yourself.

- If you do not wish to have income taxes withheld, select the option to stop withholding.

- Sign and date the form to authorize your selections.

- After completing the form, save your changes, then download, print, or share it as needed.

Complete your Uia 1581 form online today for efficient management of your unemployment benefits.

Related links form

If your employee has been a victim of suspected ID theft, they may receive a letter from UIA Form UIA 6347, Request for Identity Verification. Employees should submit the requested ID verification documents, along with the Letter ID found on Form 6347 through their MiWAM account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.