Loading

Get 355s 2011 Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 355s 2011 Fillable Form online

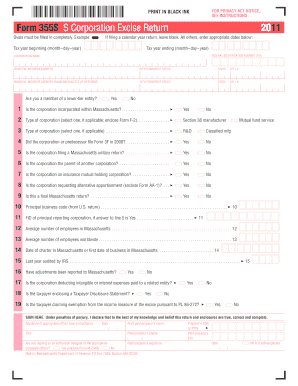

This guide provides clear and detailed instructions on how to complete the 355s 2011 Fillable Form online. It is designed to assist users of all experience levels in accurately filling out this important form for S Corporations.

Follow the steps to effectively complete the form online.

- Click 'Get Form' button to obtain the form and open it in your preferred editing software.

- Begin by entering the tax year details at the top of the form. If filing for a calendar year, leave the field blank. For other filing options, enter the appropriate start and end dates.

- Provide your Federal Identification Number (FID) and the corporation name in the designated fields to ensure proper identification.

- Enter the principal business address along with city, state, and ZIP code. If the business address in Massachusetts differs, provide that information in the respective sections.

- Answer the questions regarding your corporation's structure and membership. Mark 'Yes' or 'No' for the relevant queries about lower-tier entity membership, incorporation status, type of corporation, and others as listed.

- Complete any required calculations on the excise assessment section, detailing property values and income data as necessary. Ensure that all figures align with supporting documentation.

- Review each schedule (A, B, C, etc.) as prompted, filling in the requested financial information from your accounting records, ensuring each part corresponds accurately to your corporation's financial statements.

- Before signing, verify the accuracy of all entries on the form. An authorized officer must sign and date the return under the penalties of perjury statement, affirming the correctness of the return.

- Finally, save your document, and you may download, print, or share it as required for your submission to the Massachusetts Department of Revenue.

Complete your 355s 2011 Fillable Form online today for a smooth submission experience.

Corporate Excise: Basic Structure Gross Receipts or SalesequalsMassachusetts Taxable IncomeTaxable Massachusetts Tangible Property or Net WorthApplyApplyTax Rate (9.5% or respective S-corp rates)Tax Rate of 0.26%30 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.